At Fire Police City County FCU, we are committed to our members’ financial success. Financial success includes financial security. As more and more threats appear with the development of technology and social media, we aim to keep our members educated about new scams and frauds.

Identity Theft

We strive to protect our members. Identity theft is a growing problem around the world. Once your information is captured, it can be used to get financial products in your name. Be vigilant to identify possible scams. Protect yourself and do not give your personal information to anyone.

Good practices for preventing identity theft:

- Credit Lock: You may choose to place a “fraud alert” lock on your and your child’s credit reports through the three major credit bureaus: Equifax, Experian, and Transunion.

- Online Risks: Be aware of website and e-mails scams. Fraudsters take advantage of modern communication tools to avoid “face to face” contact. Victims are asked to send money using money transfer services, including those offered by your credit union. Never use e-mail links to provide your information.

- Phone Risks: Scammers may contact members over a series of phone calls to build a rapport and convince them to send money. Scammers also have the ability to spoof phone numbers so the call appears to be coming from your credit union. We will never ask for your personal information, such as your debit card number, account number, or passwords; access to your computer; or for you to wire money over the phone.

- Insurance Fraud Risks: Holds are placed on certain checks to ensure clearance at the issuing financial institution. This safeguard is aimed to mitigate risks to both our members and the Credit Union.

- Two-Factor Authentication: Whether it’s your email, social media, or your bank account, the many accounts you access on a daily basis store a wealth of personal and financial information. Unfortunately, a password isn’t enough to keep this information safe from cyber-attacks. A simple way to combat this is by turning on two-factor authentication where it’s available. When you access your FPCCFCU accounts through It’s Me 247 Online Banking, any change you attempt to make to your personal information will require a code sent via email or text. This way, we can ensure our members’ accounts are safe and secure even if their passwords are obtained through phishing attacks or other scams.

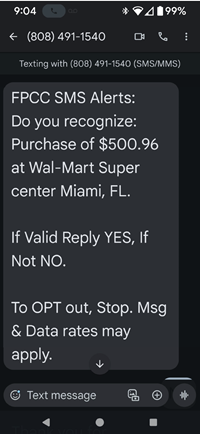

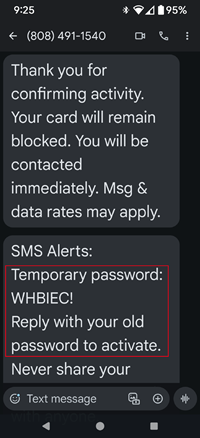

- Text Scams: Beware of text messages claiming to be from FPCCFCU. While we may send our members texts, we will never ask for your passwords. See the images below for an example of a fraudulent text message. In this instance, the member was sent a temporary password and asked to respond with their old password. This is a clever way for a scammer to attempt to obtain the member's password and access their account. If you ever feel uncomfortable with a call or text message from us or our fraud department, please hang up and call us directly at 260-484-2102. If it is after hours, you can contact us the following business day.

Protecting Your Children

Young people are easy targets because the theft may not be realized until years later, when the victim tries to open a new bank account or apply for his or her first credit card. Some warning signs of child identity theft include:

- Pre-approved credit-card offers arriving in the mail for your child

- Bank, credit-card or other financial statements that arrive in your child’s name (this excludes those accounts that are held jointly by you and your child)

- Collection-agency notifications or calls in your child’s name

Be Vigilant!

Call 260-484-2102 immediately if you feel your account has been compromised or if you have been a victim of fraud.

Reporting Fraud

As soon as you report suspicious activity on your account, the Credit Union, other institutions and the authorities can take steps to assist you. If you become a victim of fraud, do the following:

- Review your financial statements and recent transaction histories from all financial institutions, brokerage firms and credit card companies to determine suspicious activities.

- If checks are missing from your checkbook, issue stop payments on each check and come in to one of our locations to close the compromised account then open up a new account.

- If your driver’s license is missing, contact your local Bureau of Motor Vehicles office.

- If your Social Security card is missing, contact the Social Security Administration.

- Notify Fire Police City County FCU immediately and let us know of these suspicious activities. Ask to have your account numbers, PINs and passwords changed immediately.

- Notify any other financial institution(s) and credit card companies.

- File a report with your local police department and obtain a copy for your records.

- Document what happened, when it happened and to whom you spoke.

You can also find tips on avoiding scams and fraud from the Federal Trade Commission.